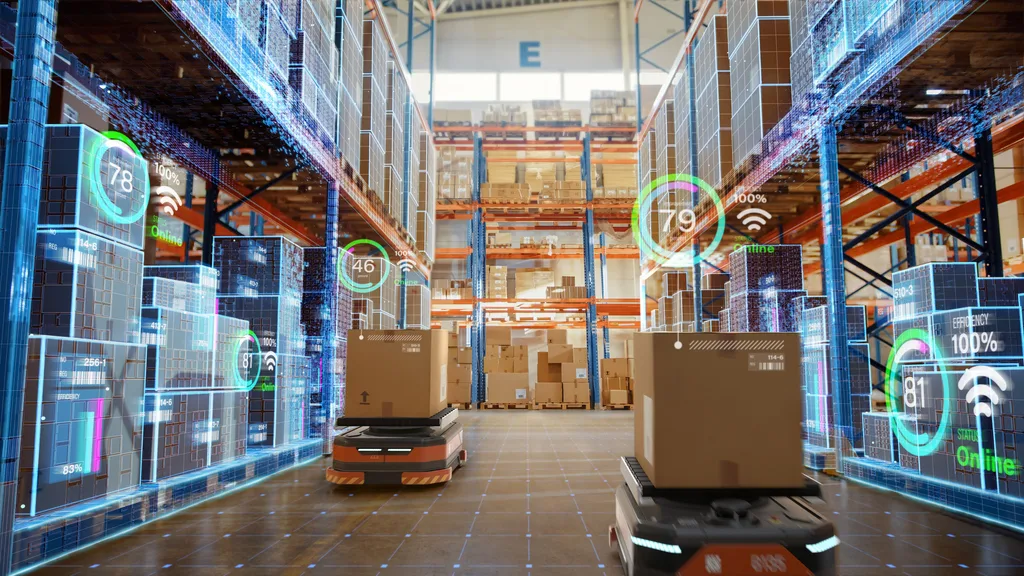

Report: 26% of warehouses to be automated by 2027

More than a quarter (26%) of warehouses are expected to be automated by 2027, from 14% just a decade earlier, says Rueben Scriven.

THIS IS a steep rise from 18% at the end of 2021, demonstrating how a number of key factors, including labour shortages and the acceleration in e-commerce fuelled by the Covid-19 pandemic is driving the market.

{EMBED(1256973)}

According to our forecasts, the use of automation in warehousing will continue to expand. This is despite a predicted fall of 35% in the number of new warehouses added to global building stock during 2023 compared with the previous year, largely as a result of the global economic downturn and a post-Covid market correction.

Short term dip

Although we are expecting a dip in demand for end-to-end automation solutions in the short term, many companies are expected to continue to spend on automation, focusing instead on their existing assets, rather than investing in new or larger automation projects.

Low hanging fruit

Our latest report on warehouse buildings, footprint and labor shows the food & beverage, and parcel sectors have the highest penetration rate of warehouse automation, and they will continue to be ‘low hanging fruit’, due to both the predictability of throughput and the size/weight of items handled.

Despite the high growth forecast for warehouse automation systems, market saturation remains a long way off. For example, the ROI of an automated sortation system is high as a result of the increased throughput rates it offers compared with manual sortation, coupled with the potential to reduce labor costs and fill skills gaps.

Warehouse drop

Although investment in automation is set to continue, our analysis indicates the global economic downturn, high interest rates and the slowing trend towards e-commerce have hit warehouse construction hard, in particular fulfillment centres. As a result, the number of new warehouses added to global building stock is anticipated to drop from nearly 10,000 in 2022 to 6,700 in 2023, but still above pre-Covid levels.

We don’t think this 2023 dip in warehouse construction is due to an underlying lack of demand, but is more the result of the current economic climate, high interest rates and the sheer volume of capacity added in 2021 and 2022. With this in mind, the slowdown in warehouse building is likely to be short-lived. As demand remains fairly consistent, we predict rent prices will increase in the mid-term and e-commerce will continue to drive demand for new facilities over the longer term.

Global e-commerce online sales are projected to more than double over the five years to 2027, driving growth in global warehouse stock of 28,500, a large proportion of which are expected to be direct-to-consumer fulfillment centres, which will require substantial automation and labour.

Rueben Scriven, senior analyst, Interact Analysis

For more information, visit https://bit.ly/42Jiw3t

{EMBED(1256974)}